-40%

"The Civil War Tax in Louisiana: 1865" - Property Owners & Assessments by Parish

$ 10.56

- Description

- Size Guide

Description

Up for sale is a book that will be of great interest and utility to the genealogist but also to the historian.Title:

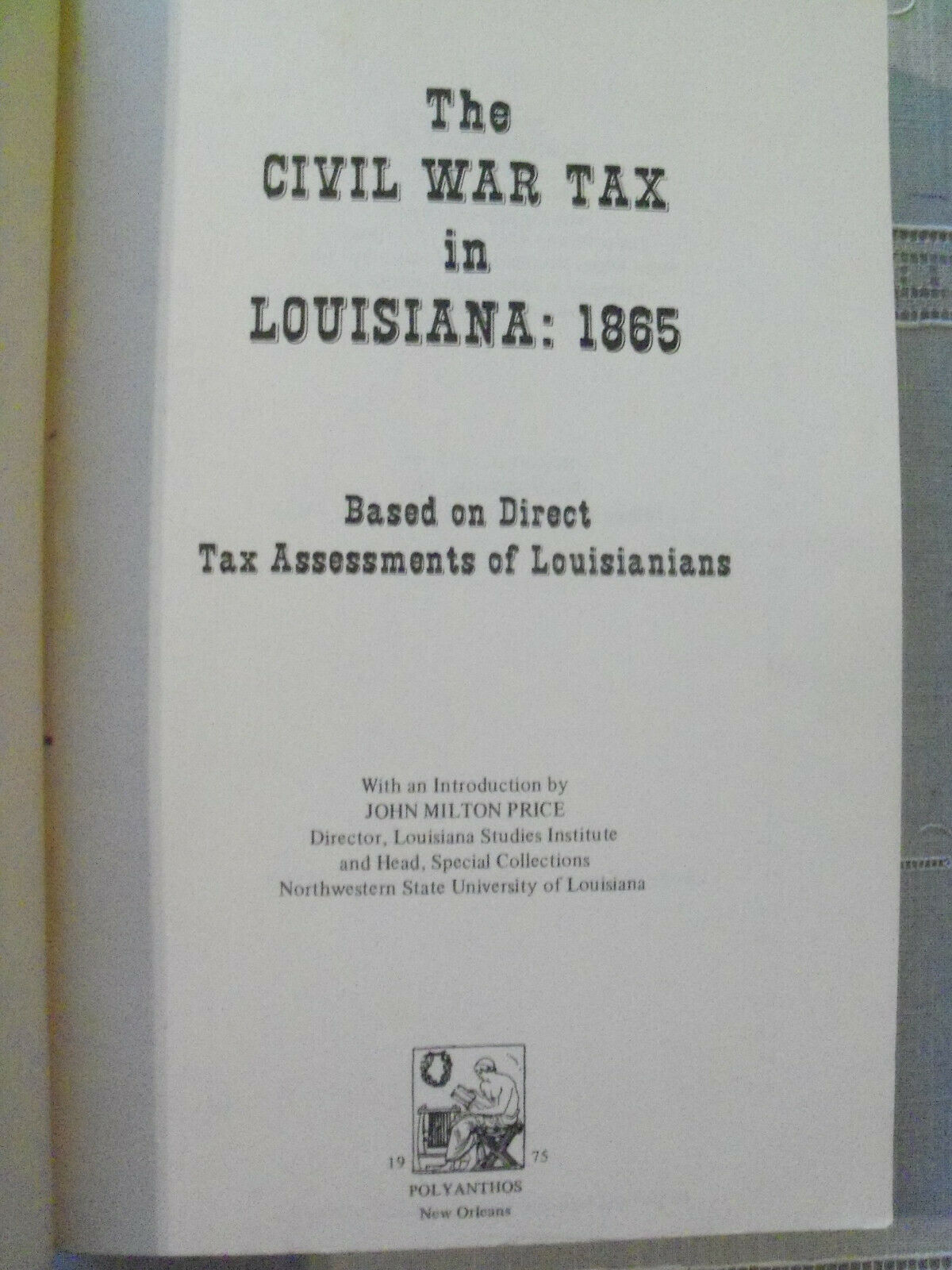

The Civil War Tax in Louisiana: 1865

Subtitle:

Based on Direct Tax Assessments of Louisianans

Introduction by: John Milton Price (Director, Louisiana Studies Institute and Head, Special Collections, Northwestern State University of Louisiana)

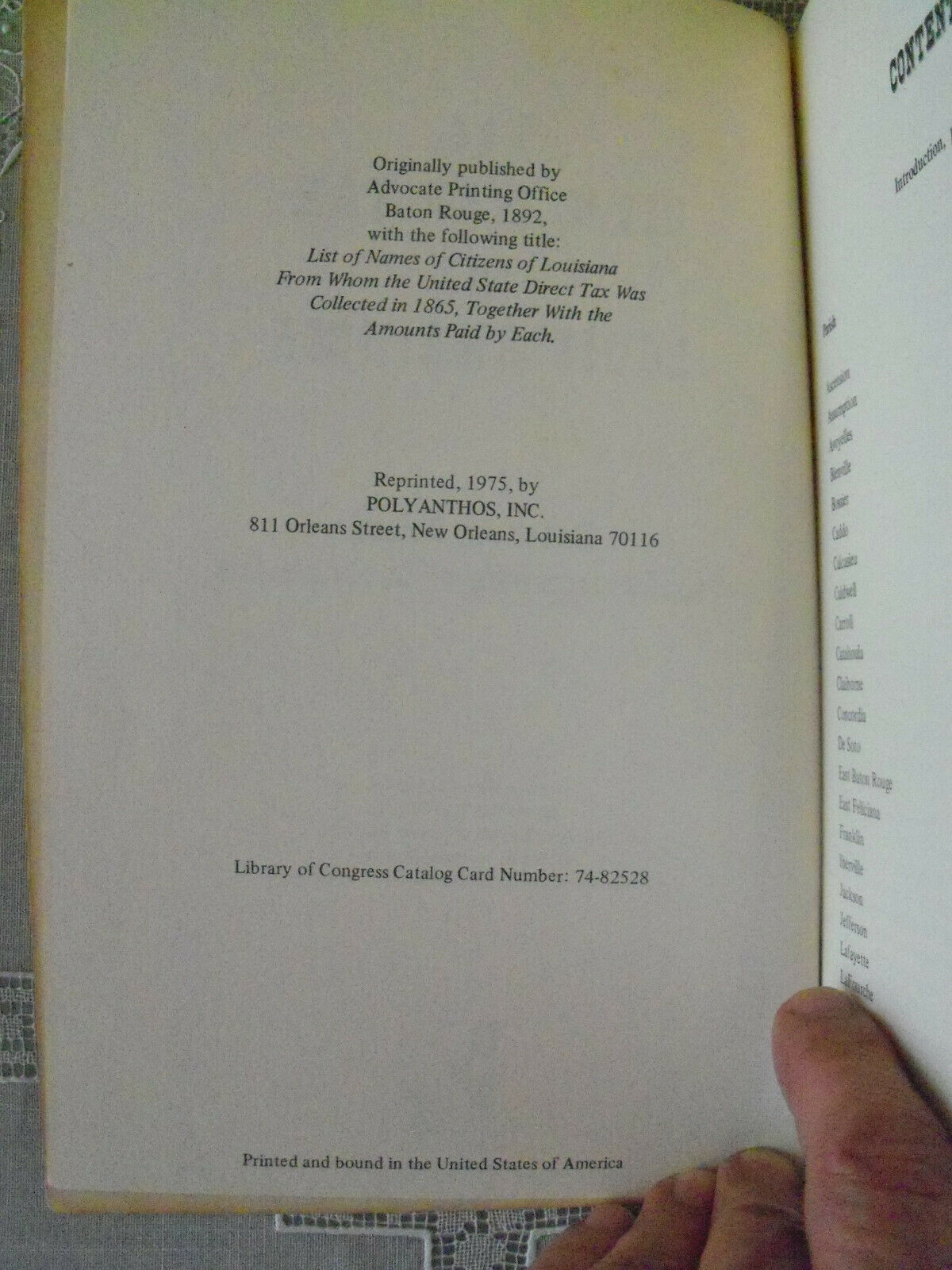

Originally Published: 1892, Advocate Publishing Office, Baton Rouge (under the title

"List of Names of Citizens in Louisiana From Whom the United State (sic) Direct Tax Was Collected in 1865, Together With the Amounts Paid by Each"

)

Reprinted: 1975, by Polyanthos, Inc., 811 Orleans Street, New Orleans, Louisiana 70116

ISBN: None found

Library of Congress (LOC) Catalog Card Number: 74-82528

Paperback book

Just under 9 inches tall by just under 6 inches wide.

Pages: 354, plus two pages of forms (discussed below).

With the start of the Civil War, the United States faced the challenge of raising the funds required by the military. On August 5, 1861, Congress passed a "direct tax" which was intended to raise the sum of $ 20 million dollars. The "direct tax" is explicitly mentioned in Article I, Section 2 of the Constitution, which states:

"Representatives and Direct Taxes shall be apportioned among the several States which may be included in this Union, according to their respective Numbers, which shall be determined by adding to the whole Number of free Persons, including those bound to Service for a Term of Years, and excluding Indians not taxed, three fifths of all other Persons."

The new tax was fundamentally a property tax; it provided that the

"direct tax ... shall be assessed and laid on the value of all lands and lots of ground, with their improvements and dwelling houses ..."

The original language of the 1861 law stated that the "direct tax" would become annual. However, by 1862, Congress had backed off and it appears that the "direct tax" was collected only once. (An income tax had been enacted at about the same time and this revenue stream was continued.)

Although the 1861 "direct tax" law described a process of making assessments and generating bills for every property owner, states were given an alternative. Each state could assume financial responsibility for its share of the total "direct tax" and pay this amount to directly to the federal government. The state would pay the bill, rather than individual taxpayers. In fact, the law provided an inducement for states to use this mechanism. States who paid up by July 1, 1862 would receive a 15% discount; those who paid up by October 1, 1862 would receive a 10% discount. All of the Union states, except Delaware, chose to use this provision. [Actually, they "paid" their quota with in kind military support services, so that very little money actually changed hands.]

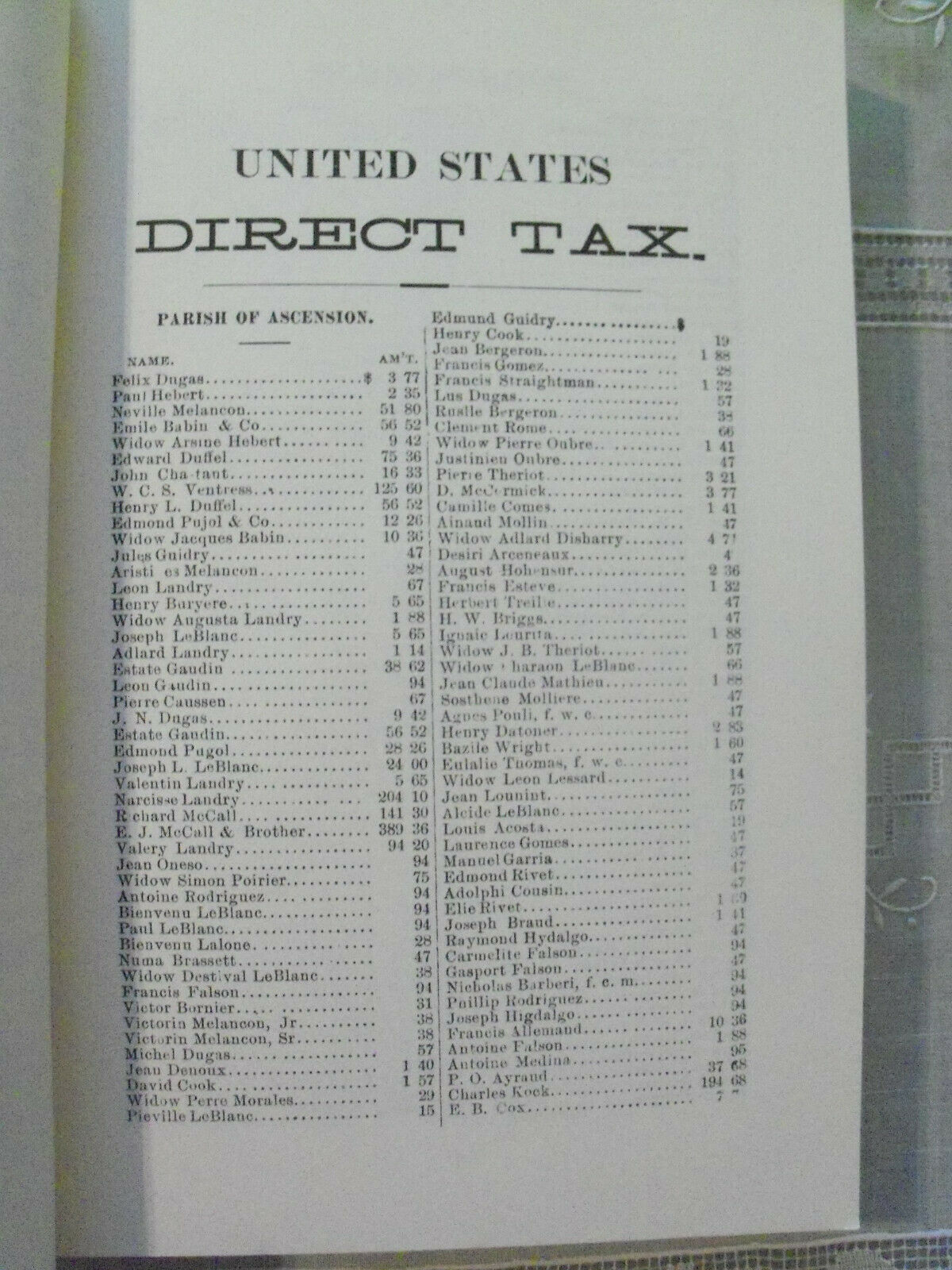

For obvious reasons, the eleven states that seceded and joined the Confederacy did not pay the "direct tax" either directly or by assessment and taxation of individual property owners. However, with the Union prevailing in the Civil War, the tax was collected at war's end. Louisiana's original "direct tax" apportion was $ 385,887.00 The tax was finally collected, from the individual property owners, in 1865. The book I am selling has lists of property owners, and the dollar amounts of their "direct tax" assessments, organized by Parish. [This statement applies to all Parishes except one. For Calcasieu Parish (located in far southwest Louisiana and including the city of Lake Charles), no tax was collected in 1865. I don't know the reason for this.]

You may be wondering why a list of property owners and of the "direct tax" they had paid in 1865 would have been published in 1892. The answer is a very practical one. In the early 1890s, the United States had a fiscal surplus and Congress decided to REFUND the "direct tax" from 30 years previously! This explains the two forms at the end of the book. The first is called "Direct Tax Claim of the Original Payer" and was meant to be completed by taxpayers who were still still alive. The second is called "Direct Tax Claim of the Legal Representative" and was meant to be completed by legal heirs on behalf of taxpayers who were now deceased. So, in the 1890s, Louisianans primarily consulted this book to see if they were entitled to a tax refund. Today, genealogists and historians will find the book valuable because it directly relates specific taxpayers to specific Parishes and gives an idea of the relative extent of their property holdings compared to others.

(Note: Information from the above paragraphs is taken, in part, from John Milton Price's Introduction to this book and also from an 1889 article by Charles F. Dunbar in the

Quarterly Journal of Economics

.)

Please see above for complete description of condition and photos. Sold as is.

Attention US Buyers: I will ship by USPS Media Mail or by USPS Priority Mail, your choice. Please note that if you have a Military Mail address (e.g. APO), I must ask that you choose USPS Priority Mail as it is my understanding that USPS Media Mail is unreliable to Military Mail addresses.

Attention International Buyers: Unfortunately, it appears that international shipping from the US (via the USPS) has become unreliable, because of the pandemic. Therefore, I have decided to remove the international shipping option. You are still welcome to bid on this item, but will need to supply a shipping address in the US. I'm sorry for the inconvenience. Thank you for your understanding.